How Industrial Manufacturers Use Technology to Partner with Distributors

There are two options for industrial manufacturers to get their products to the end user; direct sales and distribution sales. The distribution channel has existed for as long as there have been manufacturers. Consider one well known manufacturer of fittings and valves. Beginning in the 1940’s, the company began to grow rapidly with a direct sales model but soon found demand outpacing their ability to effectively sell and ship direct to customers all across the country. The company quickly adopted a distribution model by funding independent, yet exclusive, distributors in major industrial markets. Exclusive, meaning the distributors sell only the company’s products. Though this model is somewhat unique in the industry, it has proven successful. However, many other major

manufacturers in the same market have elected to use independent distributors who may be exclusive to their product line, yet sell additional “complimentary” products from other manufacturers to provide a broader category of ancillary products to the end user. Also in the 1930’s and 40’s, a broader channel of industrial distributors began servicing the specific needs of maintenance, repair and operations at end users. MRO suppliers typically provide everything from nuts & bolts, to cutting tools, abrasives and even fittings & valves. They buy from manufacturers and mainline distributors, and inventory these parts at central locations in order to readily supply the end user. Though initially this distribution channel focused on automotive repair shops, it quickly began servicing manufacturing plants.

Companies often have millions of dollars invested in equipment, and their profitability depends on uptime. If a machine in a plant or heavy equipment on a construction site goes down and they do not have the right parts or tools for repair, it can cost the company many hundreds to many thousands of dollars per hour in lost productivity. This is where the MRO supply

chain provides common parts to the customer’s

inventory, or less common or specialty items in the most cost effective and shortest lead time possible. Often delivering the required item(s) the same day. Traditionally, the MRO supply business was referred to as “filling the bins”. Where the supplier has distribution centers that stock products from multiple manufacturers and sales agents that make regular stops at the customer’s location to resupply frequently used items and take orders for “special” items the company may need that day, week or month. Though this model is still used by many suppliers, times have changed and in most cases vendor managed inventory has taken the place of “filling the bins”. With vendor managed inventory (VMI), the customer shares their inventory data electronically with a vendor, allowing the vendor to determine required order size and frequency.

Understanding the Relationship

From MRO to major industrial supply companies, the manufacturer-distributor relationship is by nature an interdependent one. Though it appears very elementary, manufacturers depend on distributors to get their products to market and in turn distributors would not have a reason to exist without the manufacturers who supply them. However, at the core, each organization has their own objectives and goals. Though in order for the relationship to benefit each party, they both have an obligation to work together to understand the needs of the partnership. The goal is to have a symbiotic relationship that will go beyond a simple transactional association to one that provides seamless communication at many levels.

From the Old Days of Paper and Fax Machines to Electronic Communications

Today, the relationships in industrial distribution are complex, requiring channels of communication between manufacturers of parts and components to effectively communicate with their distribution network electronically, on a real-time basis. This method of communication is known as EDI, electronic data interchange. EDI sends digital information from one business system to another and makes the connection between the manufacturer and distributor via e-commerce, CMS, ERP, WMS, accounting software and more. The use of electronic data communications replaces the traditional order processes that used to be accomplished with paper or fax.

A recent survey of 1,000 industrial supply chain executives was conducted to ascertain the primary technologies that are affecting their businesses. The output of the survey identified inventory and network optimization, cloud computing software and data storage, predictive analytics and IoT (the Internet of Things) as the principal components. It is projected that at their current pace manufactures will have spent over $280 billion annually on the digitalization of their supply chains by 2020. This goes beyond the simple adoption of technologies. Manufacturers and distributors must instead emphasize how to best utilize these technologies in a more economical and effective manner to develop an empirically ‘smart’ supply chain. Manufacturers and their partner distributors that employ scalable technologies that effectively exchange and make use of information in real-time can optimize their communication platforms and significantly improve supply chain performance.

Lead Sharing: EDI is More then Just Order Fulfillment and Forecasting

Most RFQs, leads and inquiries come in through the manufacturer. From trade show inquiries, to advertising and most importantly direct to a company’s website, the flow of leads is the life blood of new business. It’s the handoff from manufacturer to distributor that’s critical. Companies spend a great deal of money and time to cultivate marketing qualified leads. Simply emailing the lead to the point person at a distributor lacks accountability and can be as nebulous as the days of mailing “bingo leads” out the field. It can be like a black hole. One study found that 76% of manufacturer principles consider sales leads as the most valuable component to their selling process. That being the case, it’s imperative for the principle to have a consistent flow of high quality leads to their distributor partners in a format that ensures immediate follow-up and allows for easy and trackable feedback. This can be achieved via automated systems that share and track leads, as well as capturing feedback from the distributor for reporting and analysis by the manufacturer.

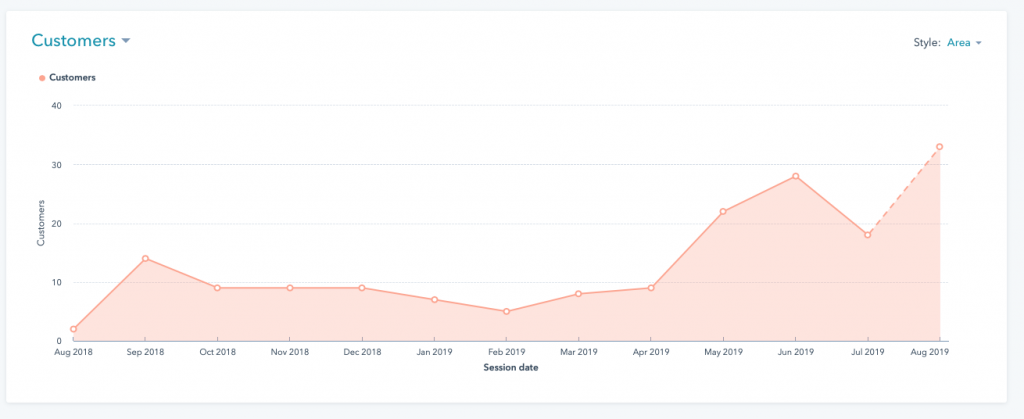

As we’ve mentioned, leads are generated from many different sources. An inquiry from a simple “contact us” form, or second source digital advertising may only provide very basic information such as name and email address. However a lead generated from InBound digital marketing can be extremely valuable. When funneled and nurtured properly by the manufacturer through the digital marketing process it shows user intent, which typically uncovers what product or application the prospect is likely to be interested in. Below are examples of results from effective digital marketing.

FORM CONVERSIONS

CUSTOMER ACQUISITION

Another highly qualified lead may be via an RFQ form with detailed information or perhaps even a drawing upload or selection from a manufacturer’s online CAD file download. These leads will likely provide very specific and valuable intent based data for the distributor sales person. However, due to the disparities between how leads are generated and the data they provide (or lack of data), manufacturers must aggregate and format leads in a uniform manner that will best serve the distributor and enable them to provide detailed feedback and empower them with the best opportunity to close the sale. And since each lead source has the potential of providing different types of data, manufacturers are sometimes generating leads that are not considered “sales-ready”. In fact it has been reported that sales reps waste an average of 546 hours per year on leads that have not been accurately appended and formatted.

Often, the hand off is much easier to talk about than it to do effectively. It’s no secret that effective sales and marketing alignment can be challenging, yet when employing strategic electronic protocols it serves both parties with the most valuable way to continually increase sales. A recent study by Aberdeen Group reported that organizations that focus on the relationship between sales and marketing grow revenue 32 percent faster than those that don’t.

When sales and marketing work together as a cohesive team marketing ROI, sales productivity and top-line growth have an exponentially positive impact for both the manufacturer and distributor. Yet this cannot be accomplished without sophisticated technological protocols. Though even when leveraging technology, there are still challenges.

Maximizing the Distribution Network

As manufacturers generate leads and pass them to distributors who are responsible for the follow up and nurturing process, there can still be a disconnect because systems and process are often very different between the two entities. Plus, top line distributors work with many different suppliers, including competing manufacturers. It is not enough to manufacture top quality product at competitive prices. The companies that are likely to gain more attention from the distributor are those that make the flow of leads, orders and all other transactional activity easier.

Technology is best used when it enables fast and easy feedback from distributors, whether they are at a central or branch location, or out in the field. This means choosing e-solutions that work with smartphones, tablets and wireless computers to ensure the user experience is easy to understand and use. It is vitally important to have systems in place that will be readily adopted and used by everyone in the supply chain, from manufacturer to distributor locations to the sales person in the field.

Consider the example of Motion Industries, a major industrial distributor whose core offerings include bearings, power transmission and fluid power products. The company serves local markets with over 550 branch locations, distribution centers and customer service centers throughout North America.

They employ a sophisticated e-business system that allows for greater

integration and efficiency in the supply chain for both customers and

manufacturers. Motion Industries’ systems integration often includes integrating with Computerized Maintenance Management Systems (CMMS), Enterprise Resource Planning (ERP) and other purchasing or financial systems. The level and complexity of integration often involves developing “customized” interfaces with supply chain partners. Motion establishes direct system communication with its key suppliers to allow their branch personnel real time access to pricing, availability, order entry and order status. Flexible architecture and interaction from system to system with multiple manufacturer suppliers provides transaction response times within

the specified requirements, which allows for implementation of point-to-point connection with the supplier and Motion Industries’ systems.

connection with the supplier and Motion Industries’ systems. Referred to as “MI Supplier Connect”, the system results in increased efficiency and service for all parties, particularly where it is most important; for the end user.

More than Traditional Industrial Manufacturer-Distributor Relationships

Even in the industrial sales channel, e-commerce has been a disruptive force in the traditional supply chain. Today’s buyers are accustomed to having the same detailed data in the workplace as they do in online home purchases. They expect everything from immediate access to pricing, product availability and tracking of the in-route precise location of their order.

It has been reported that e-commerce giant Amazon Business’s B2B operation is targeting industrial distributor Grainger’s position in the industrial supply market. This is not to say Amazon will displace the major industrial distribution channel, but it does suggest that industrial distributors need to offer e-commerce for popular products and leverage some of the strengths behind the sophisticated communication it brings. This suggests emulating the approach and digital tactics that make e-commerce companies successful.

Manufacturers and distributors should adopt some of the effective strategies of e-commerce when it comes to their own digital communications.

Industrial manufacturers and distributors are known to be highly efficient in managing the supply chain for the end user. However, by employing some of e-commerce’s strategies they can more effectively up-sell and cross-sell their customers with other digital technologies.

As distributors put emphasis on the strategies of e-commerce platforms they will have a higher level of expertise in data-driven business development.

CONCLUSION

Industrial manufacturers and distributors must partner together in taking an omnichannel approach, much like the retail environment. They must ensure the buyer has seamless access to availability, pricing and delivery. Because the end user rarely interacts directly with the manufacturer, the distributor must have real-time access to information from the manufacturer they may need to pass along to the customer.

Sometimes the relationship needs to include the ability to drop-ship from the manufacturer directly to the end user on behalf of the distributor. This can only work seamlessly when there are technologies in place that protect the manufacturer- distributor relationship. It can never be overlooked that the distributor owns the relationship with the end use customer.

Achieving the maximum performance from distributors requires providing the tools they need, which is a unified, electronic system-based approach that keeps the channels of communications open and flowing. By following up-to-date technology based protocols manufacturers can increase communication and collaboration with their distributors. These methods increase revenue and strengthen the benefits of the manufacturer-distributor relationship.

An industry will only thrive when all parties work together by having responsible and ethical practices at the forefront of their businesses. And customers will keep coming back if those principles are clear to them. When there is satisfaction across all partners in the manufacturing of a product or equipment, the trickle up effect is to the end use customer’s perception. And it’s a well known fact; perception is reality.

SOURCES:

LeadLift, LLC

Industrial Distribution

Conveyco

SPS Commerce, Inc.

LeadMethod, Inc.

Motion Industries, Inc.

Veridian

Modern Pumping Today